Support

The Berry Center

Friends,

We thank you for visiting our page and taking the next step in supporting the work we do every day.

You can support The Berry Center in many ways: your donation, of any amount, enables us to advocate for small farmers, land-conserving communities, and healthy regional economies. Joining our Legacy Society and making a planned gift means you are creating a lasting investment in the future of the center for many years to come. Volunteering is another way you can give your time and energy to a cause you are passionate about.

JOIN THE BERRY CENTER MEMBERSHIP

SUPPORT THE LEGACY PROJECT

SIGN UP FOR EMAILS AND THE BERRY CENTER JOURNAL

Join The Membership

“The way we are, we are members of each other. All of us. Everything. The difference aint who is a member and who is not, but in who knows it and who don’t” – Burley Coulter, from The Wild Birds: Six Stories of the Port William Membership by Wendell Berry (North Point Press, 1968)

The Membership

With a donation of any amount you are considered a friend and member of the Center. Your membership includes 10% off most purchases at The Berry Center Bookstore, our annual Berry Center Journal, and seasonal e-newsletters.

Sustaining Members

Annual, quarterly or monthly recurring online payments are a secure and easy way to make a larger donation more affordable and provides a steady income stream for the Center. Your reliable gift helps us focus on program development and less on fundraising.

Port William Circle

By joining the Port William Circle with a donation of $1,000 or more annually, you will provide significant support for The Berry Center programs and initiatives. Port William, Kentucky, is a fictional rural town found in Wendell Berry’s novels, short stories, and poems. It is a special place that reflects true community and connection. You can become part of this community by supporting the programs that are truly making a difference in our community. Your membership will include a signed broadside by Wendell Berry, 10% off at The Berry Center Bookstore, our annual Berry Center Journal, and seasonal e- newsletters.

Ways To Give

Online: Make a secure online payment by clicking the button below. This is an easy way to set up a recurring payment or make a one time gift.

By Mail: Gifts can be paid by check to The Berry Center and mailed to P.O. Box 582 New Castle, KY 40050.

Matching Gifts: Maximize your impact with a matching gift from your employer. Contact your human resources department for more information on their specific giving programs.

Stock Gift, Donor Advised Fund, IRA Rollover, Gift Annuity, Charitable Trust, etc.: There are many creative ways to give to a non-profit. Please consult your financial advisor for more ways you can support The Berry Center.

Planned Giving

Make a lasting impact by making a planned gift through your estate or an immediate gift that returns income. Your planned gift will help us carry out our mission of putting Wendell Berry’s writing into action for many years to come. You’ll receive significant tax savings while providing for a cause that you believe in. Some options for how to plan your gift include:

Ways To Give

Bequest: You designate our organization as the beneficiary of your asset by will, trust or beneficiary designation form.

IRA Rollover: Congress has enacted a permanent IRA charitable rollover. As a result, you can make an IRA rollover gift this year and in future years.

Beneficiary Designation Gifts: You can designate us as a beneficiary of a retirement, investment or bank account or your life insurance policy.

Charitable Gift Annuity: You transfer your cash or appreciated property to our organization in exchange for our promise to pay you fixed payments (with rates based on your age) for the rest of your life.

Charitable Remainder Trust: You transfer your cash or appreciated property to fund a charitable remainder unitrust. The trust sells your property tax free and provides you with income for life or a term of years.

Charitable Remainder Annuity Trust: You transfer your cash or appreciated propert to fund a charitable remainder annuity trust. The trust sells your property tax free and provides you with fixed income for life or a term of years.

Charitable Lead Trust: You fund a trust that makes gifts to us for a number of years. Your family receives the trust remainder at substantial tax savings.

Sale and Unitrust: You give a portion of your property to us to fund a charitable remainder trust, when the property sells you receive cash and income for life.

Bargain Sale: We purchase your property for less than fair market value. You receive cash and a charitable deduction for the difference between the market value and purchase price.

Give it Twice Trust: You provide your children with a stream of income while making a

gift to charity.

Life Estate Reserved: You give your property to our organization but retain the right to

use the property during your life.

What To Give

Gifts of Stocks and Bonds: Donating appreciated securities, including stocks or bonds, is an easy and tax-effective way for you to make a gift to our organization.

Gifts of Real Estate: Donating appreciated real estate, such as a home, vacation property, undeveloped land, farmland, ranch or commercial property can make a great gift to our organization.

Gifts of Retirement Assets: Donating part or all of your unused retirement assets such as a gift from your IRA, 401(k), 403(b), pension or other tax-deferred plan is an excellent way to make a gift to our organization.

Gifts of Cash: A gift of cash is a simple and easy way for you to make a gift.

Gifts of Insurance: A gift of your life insurance policy is an excellent way to make a gift to charity. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy. For example, you may have purchased a policy to provide for minor children and they are now financially independent adults.

The Berry Center may work with donors to further their estate planning goals. Donors are encouraged to seek the advice of independent legal, tax and financial counsel in the gift planning process. The Berry Center does not provide legal or tax advice.

Contact Us:

Director of Advancement, Loren Carlson

502-845-9200

lorencarlson@berrycenter.org

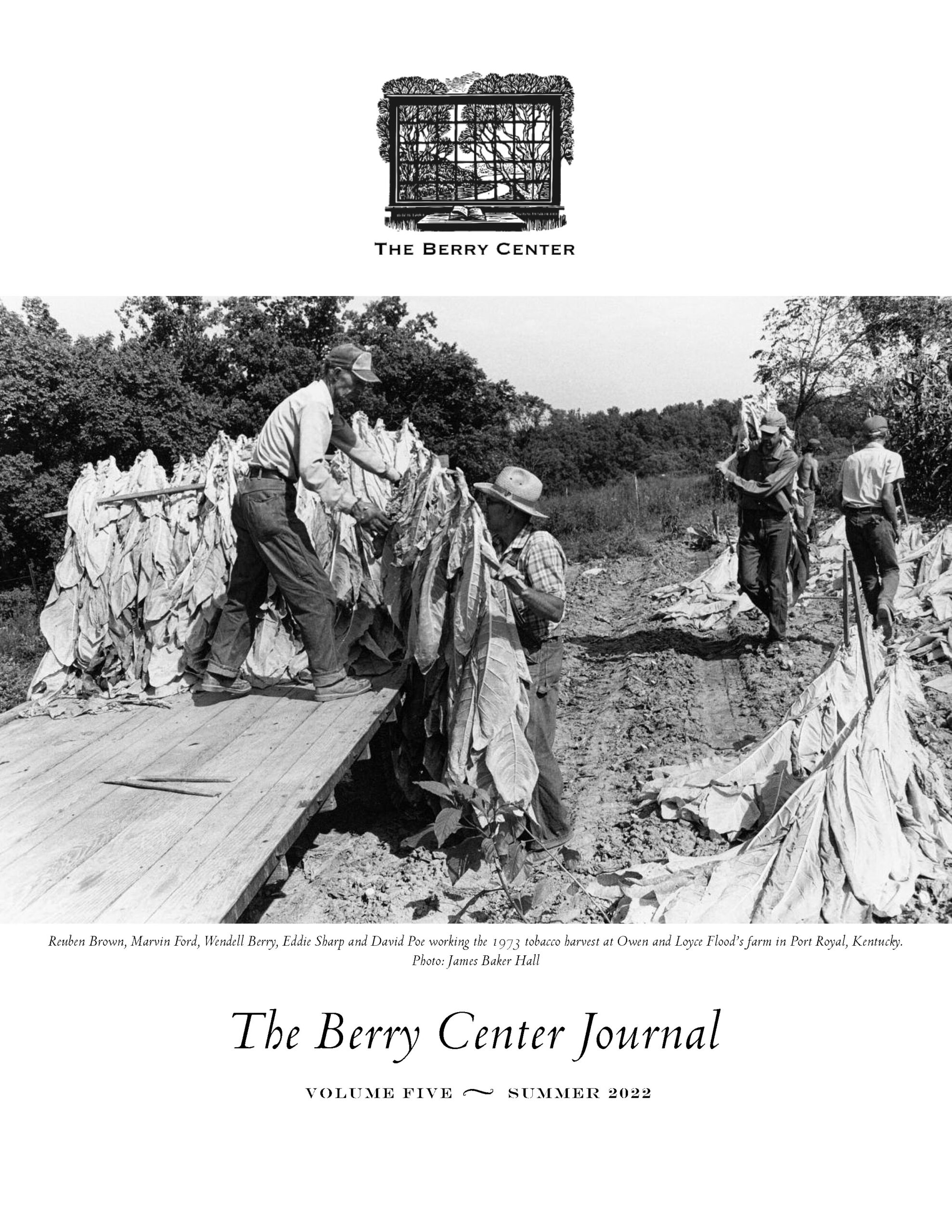

The Berry Center Journal and Newsletter

Sign Up below to receive regular updates via email about our programming, as well as our annual Berry Center journal, featuring agrarian writings, poetry, photographs, and more.

The Berry Center is a 501(C)3 nonprofit organization founded in Henry County, Kentucky, in 2011.

The mission of this organization is to put Wendell Berry’s writings into action by advocating for small farmers, land-conserving communities, and healthy regional economies.

All donations to the Center are tax-deductible as allowed by law. Our Tax ID number is 80-0721644.

Support The Berry Center

Years Of History

Preserved in The Archive Of The Berry Center, informing agrarian thought and practice, helping to chart a way forward for sustainable farming and rural prosperity.

Young Farmers

Working towards a full-time, tuition-free sustainable farming degree right here in Henry County, Kentucky, in our Wendell Berry Farming Program of Sterling College

Agrarian Books

Distributed by the Agrarian Literary League, a nationally recognized adult rural reading program from the Agrarian Culture Center and Bookstore at The Berry Center

Acres conserved

By Our Home Place Meat farmers, raising and processing the best livestock locally and humanely in a program based on the Burley tobacco cooperative model.

Donate Now